Jon Peacock of the Wisconsin Budget Project on what we need to look at with the Foxconn contract,

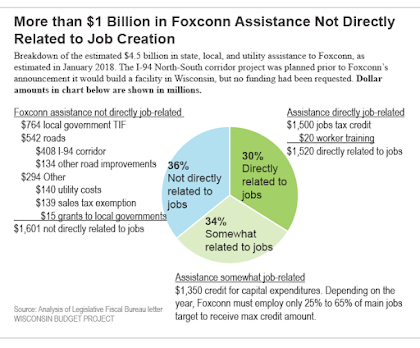

Defenders of the Foxconn deal often claim that the contract protects state taxpayers because Foxconn won’t receive any credits if it doesn’t meet job thresholds. Although that claim is true in part, it’s also very misleading. More than a third of the planned subsidies — $1.6 billion — including the state and local infrastructure spending for the project, has little or no tie to job creation.

3. The state and local subsidies per job are much higher if Foxconn falls well short of the job creation targets.

Under the contract, Foxconn can get the maximum capital investment credits even if it falls well short of each year’s job target. For example, Foxconn can receive the maximum annual cash subsidy (“tax credit”) of nearly $193 million per year even if it employs only 520 people at the end of this year (25 percent of the target level) and 1,820 at the end of 2020 (which is just 35 percent of that year’s target of 5,200 jobs). Under that lower employment scenario, the job creation payments to Foxconn would be lower, but the investment subsidies are much less tied to the job levels.In light of that factor, plus all the upfront subsidies that are independent of job creation, the total cost of state and local subsides will be much higher per job if Foxconn builds a smaller plant with fewer employees than initially promised. The huge subsidies for each job created are a concern for many reasons, including the fact that the revisions to Foxconn’s plans make it far less likely that project will have the purported employment benefits for blue collar workers and communities of color in southeast Wisconsin.

Via Foxconn – the only thing we know is that it’s a really bad scam @ Jake’s Economic TA Funhouse.